how to reduce taxable income for high earners australia

Income protection insurance should also be considered for people who earn a salary over 180000 as the premiums are tax deductible. How to reduce taxable income for high earners australia.

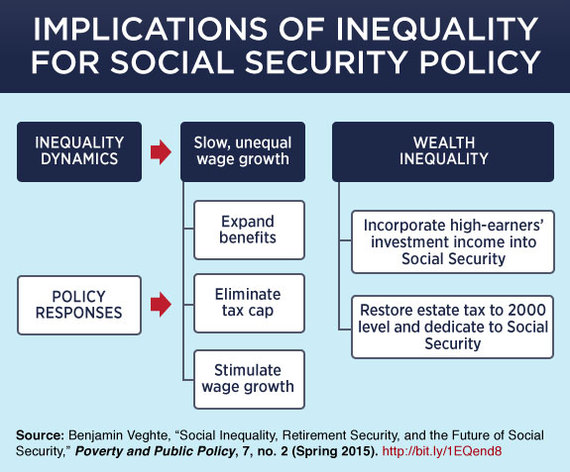

Social Security Policy Responses To Inequality Huffpost Latest News

In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

. If you can pay some of your expenses in advance you wont have to worry about paying them the next year and you can claim them as a tax deduction in the current year. Invest in an effective tax return for capital gains. Main residence the main residence capital gains tax concessions are arguably the most valuable tax break in australia for building personal and family wealth.

Do you want assets in the name of your partner. A trust for the purpose of distributing investment and business income needs to be set up. How Do High Income Earners Reduce Taxes Australia.

For all income between 0 18200 there is 0 tax 18201 45000 there is a 19 tax rate between 45001 120000 there is 325 tax between 120001 180000 there is 37 tax and. Reducing your capital gains tax CGT liability Making someone elses name your beneficiary A discretionary trust that distributes business or investment income. Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

Most of our sydney clients are in the top 15 of earners in australia. Taxable investing accounts can be very tax-efficient for these folks. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

Ensure you take full advantage of all of your tax deductions. Some of Australias highest earners pay no tax and it costs them a fortune. Most of our sydney clients are in the top 15 of earners in australia.

12 Tax Gain Harvesting. How Can Australian High Income Earners Reduce Taxes. Superannuation contribution options to reduce taxes.

How Do High Income Earners Reduce Taxes Australia. The capital gains tax CGT liability is reduced. There are many strategies to help you maximize your charitable contributions and reduce your income tax.

Tax strategies for high income earners australia. Maximizing your tax offsets involves doing some research. Maximising your tax offsets.

The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense. High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. Australia has a progressive tax rate which means the more you earn the more you have to pay tax.

Australians are using trust funds to minimise their taxable income to the tune of 35 billion a year according to a new report from the Australia Institute which found those who contribute the. Negatively gear your investment property to reduce your taxable income. Forty-five of those millionaires were able to reduce their taxable income down to below the tax-free threshold of.

Make spousal contributions to reduce your tax liability. The act of purchasing assets in the name of your partner. Find out how to lower your tax bill for 2020.

Hold investments in a discretionary family trust for tax-effective income distribution. Setting up a discretionary trust to distribute businessinvestment income. Increase the amount of tax offsets you make.

There are five income tax brackets in total. Many people dont realize this but below a taxable income of 40400 80800 married you dont pay taxes on long term capital gains or qualified dividends for that matter. You are just taking advantage of some price fluctuations to lower your tax bill.

The amount left was their taxable income. Taxable income falls into five tax brackets. How Do High Income Earners Reduce Taxes Australia.

In fact these high-income earners have legally reduced their taxes by using a simple trust distribution scheme. Tax deduction versus tax offset. Lower income earners will actually receive a refund of contributions tax.

If you want to buy assets that your partner owned you can do so. Reducing all your deductions in order to maximize them. If the investment in negatively geared then the ownership of the asset may be more tax effective in the higher income earners name as they will be able to use the amount of the negative gear to reduce their taxable income and therefore tax liability.

Make sure you maximize the deductions you can take. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Take Home Rates for an annual income of 400000.

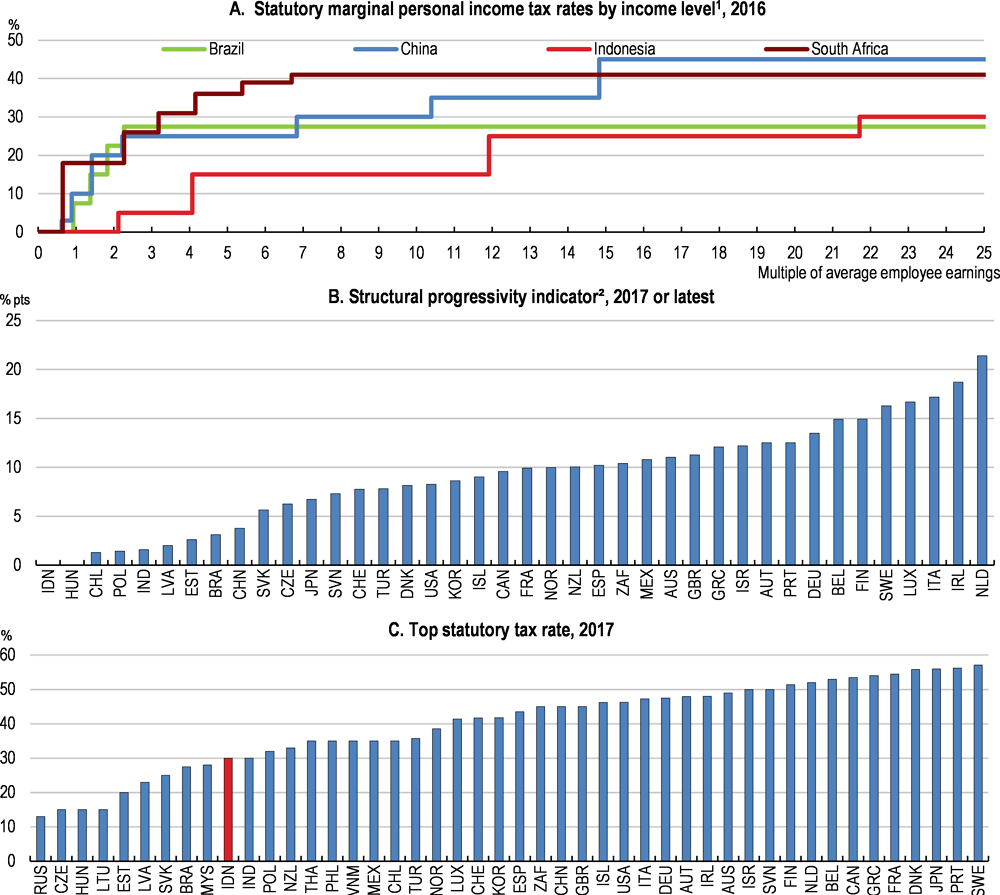

Tax offsets should be improved. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. Deductions that are entirely in line with your tax bracket.

Then they subtracted deductions such as work expenses and charitable donations. Make sure that all of the deductions you are allowed are maximized. Your annual tax payable can be reduced by pre-paying some of your tax-deductible expenses such as prepaying the interest on an investment loan.

They distribute 60000 to John. To maximize your tax offset make sure you cover taxes on your earnings. Invest in an investment bond to minimise your taxable income.

You should reduce your capital gains tax CGT liability. How Can Australian High Income Earners Reduce Taxes. To do this first they declared their total income from multiple sources such as wages bank interest and dividends from shares.

You will lower your capital gains tax CGT liability. Tax strategies for high income earners australia. A tax offset of 10000 would reduce your tax payable down to 16000.

One of the most effective ways to reduce personal taxable income is to salary sacrifice into superannuation for self employed making personal superannuation contributions this will result in a personal tax deduction. Consider salary sacrificing to reduce your taxable income. Lauren receives 30000 from the trust which is hardly taxed at all since she has no other income.

International Page 1597 Ictsd Org

Homework Chapter 20 Homework Flashcards Quizlet

Yes There Are Millionaires Who Pay No Tax But Crimping Deductions Mightn T Help Unsw Newsroom

Hard Evidence Does Income Tax And Benefits Reduce Inequality In Britain

Global Interpersonal Inequality Through The Crisis Period Financial Times

Reforming Australia S Superannuation Tax System And The Age Pension To Improve Work And Savings Incentives Ingles 2017 Asia Amp The Pacific Policy Studies Wiley Online Library

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

Reforming Australia S Superannuation Tax System And The Age Pension To Improve Work And Savings Incentives Ingles 2017 Asia Amp The Pacific Policy Studies Wiley Online Library

Reforming Australia S Superannuation Tax System And The Age Pension To Improve Work And Savings Incentives Ingles 2017 Asia Amp The Pacific Policy Studies Wiley Online Library

When It Comes To Tax How Do We Decide What S Fair

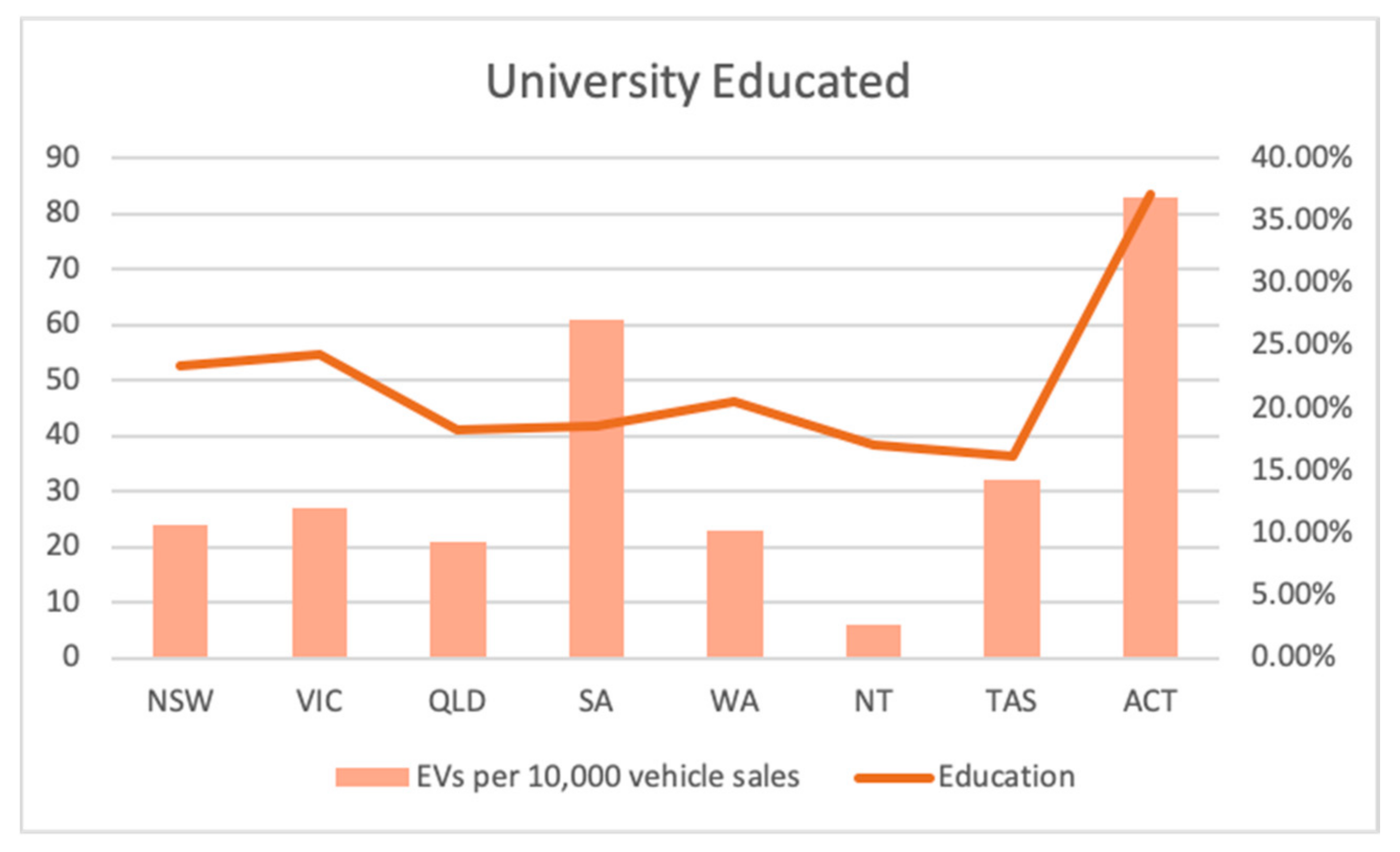

Urban Science Free Full Text Factors Affecting Electric Vehicle Uptake Insights From A Descriptive Analysis In Australia Html

Reforming Australia S Superannuation Tax System And The Age Pension To Improve Work And Savings Incentives Ingles 2017 Asia Amp The Pacific Policy Studies Wiley Online Library

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

What Is The Medicare Levy And How Much Will I Pay

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

How Do High Income Earners Reduce Tax In Australia Imagine Accounting